The CTMC–Heston model: calibration and exotic option pricing with SWIFT - Journal of Computational Finance

A Closed Form Solution for Pricing Variance Swaps Under the Rescaled Double Heston Model | SpringerLink

CLOSED FORM PRICING FORMULAS FOR DISCRETELY SAMPLED GENERALIZED VARIANCE SWAPS - Zheng - 2014 - Mathematical Finance - Wiley Online Library

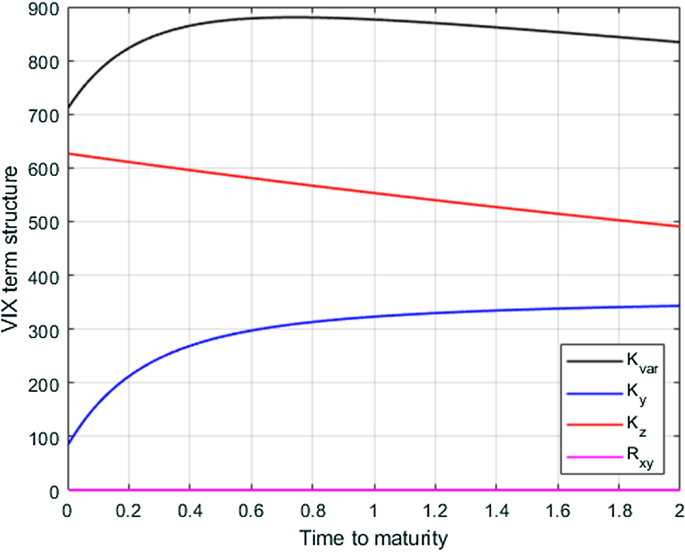

Closed-form pricing formulas for variance swaps in the Heston model with stochastic long-run mean of variance | SpringerLink

Pricing Options on Realized Variance in Heston Model with Jumps in Returns and Volatility 1 Introduction

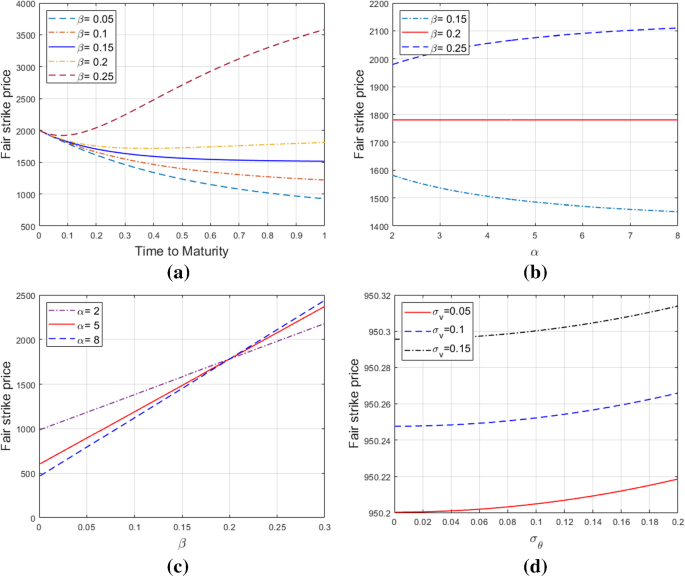

Mathematics | Free Full-Text | A Closed-Form Pricing Formula for Log-Return Variance Swaps under Stochastic Volatility and Stochastic Interest Rate

Pricing Options on Realized Variance in Heston Model with Jumps in Returns and Volatility 1 Introduction

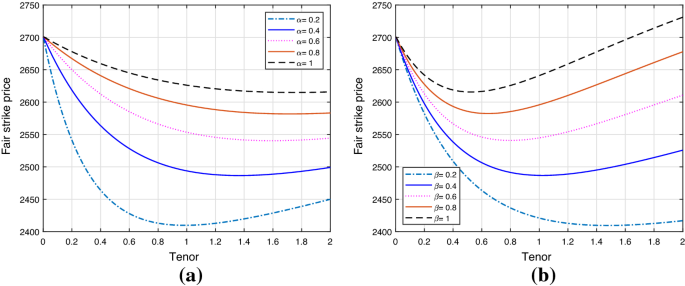

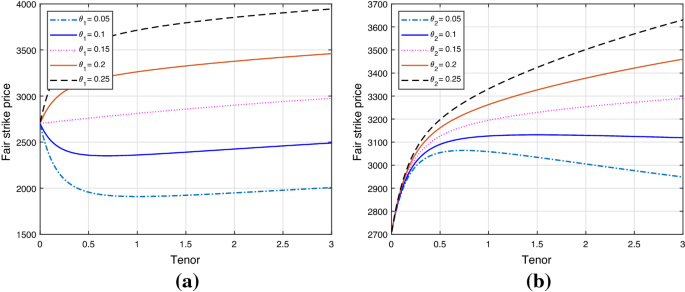

A Closed Form Solution for Pricing Variance Swaps Under the Rescaled Double Heston Model | SpringerLink

A Closed Form Solution for Pricing Variance Swaps Under the Rescaled Double Heston Model | SpringerLink

Fourier transform algorithms for pricing and hedging discretely sampled exotic variance products and volatility derivatives unde

A Closed Form Solution for Pricing Variance Swaps Under the Rescaled Double Heston Model | SpringerLink

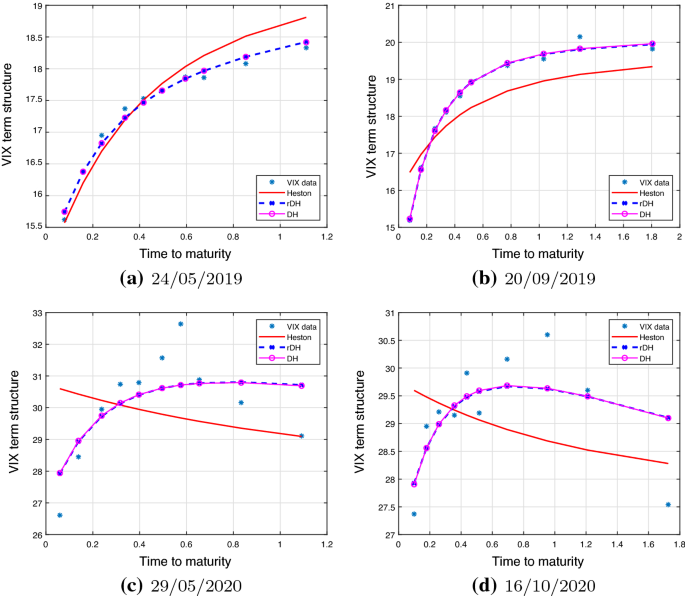

The CTMC–Heston model: calibration and exotic option pricing with SWIFT - Journal of Computational Finance

Mathematics | Free Full-Text | A Closed-Form Pricing Formula for Log-Return Variance Swaps under Stochastic Volatility and Stochastic Interest Rate